Workers’ compensation laws are in place to protect employees who are injured on the job. However, navigating the process can…

SB 47, Ohio’s New Overtime Rules Sanction Wage Theft Starting July 6, 2022 On April 6, 2022, Ohio Governor Mike…

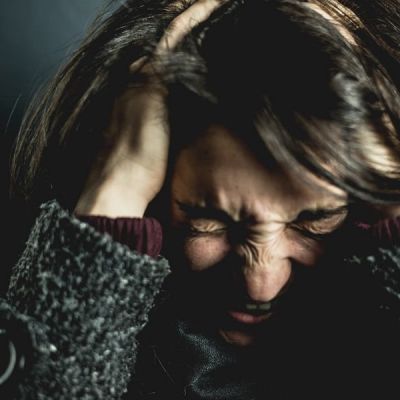

Can an Employer Be Sued for Emotional Distress in Ohio? Work is stressful enough as it is without your superiors…

Seasonal Businesses and the FLSA In response to the effect of COVID-19 on seasonal businesses, the U.S. Department of Labor…

2020 FMLA Form Updates The U.S. Department of Labor (“DOL”) recently issued several updated forms for implementing the Family and…

The State of Stripping: Employee Misclassification at the Club Employee misclassification is one of the most commonplace ways employers participate…

Severance Agreements Changes to Combat COVID-19 Related Economic Loss In the era of COVID-19, many employers are attempting to lower…

ADA Accommodations During COVID-19 For many Americans,returning to work amidst the COVID-19 crisis causes concern for the health and safety…

Updates for DACA Recipients in 2020 On June 18, 2020, another long-awaited Supreme Court ruling regarding the status of those…

Recent Law Changes and LGBT Worker Protections Using the Civil Rights Act of 1964, the Supreme Court ruled that it…

LAYOFFS AND FURLOUGHS DUE TO COVID-19 IN OHIO: WHAT ALL EMPLOYEES NEED TO KNOW. Employers across Ohio are closing their…

Wrongfully Terminated in Ohio? Here Are the Steps to Take Getting fired hurts. Losing your job creates financial problems and…